Firm Bulletin: 2025 Fees for Participating Firms

How OBSI fees are determined

As a not-for-profit organization, OBSI recovers all of its budgeted operating expenses from its participating firms each year. OBSI's budget and the allocation of this budget between the different industry sectors that use OBSI's services is approved by OBSI's Board of Directors each September.

The allocation of the budget among the five industry sectors is based on each sector’s proportionate use of our service. This is determined by the total number and complexity of the cases opened for each sector in the previously completed year. A guiding principle is that no sector or registrant category should subsidize another. Our board also considers fairness and the impact of fee changes on member firms when setting fees.

Once the budget has been allocated to each sector, fees for each firm in the sector are determined. This determination is made on the basis of firm size and case volumes as described here.

2025 is a year of significant growth for OBSI

On November 1, 2024, OBSI will become Canada’s sole designated External Complaints Body (ECB) for all federally regulated banks. Since the designation last year, OBSI has engaged in a comprehensive process of planning and preparation for this change with the transitioning banks and the Financial Consumer Agency of Canada. In advance of the transition, we have undertaken significant internal improvements, including workforce growth, operational efficiencies development, and system and process improvements to manage the anticipated growth in banking case volumes. All costs associated with the growth necessary for the single ECB transition were paid in fiscal 2024 by the banks transitioning to OBSI.

Our 2025 budget is approximately $22 million – a 20% increase from 2024 expenses. Most of this increase is associated with personnel costs and reflects the significant team growth in 2024 necessary to deal with current exceptionally high case volumes and preparation for becoming the single ECB.

OBSI has demonstrated a focused commitment to cost control and responsible stewardship of participating firm fees over many years. In the post-pandemic period, dramatic increases in complaint volumes have required significant organizational growth and further investments in technology and efficiency improvement initiatives.

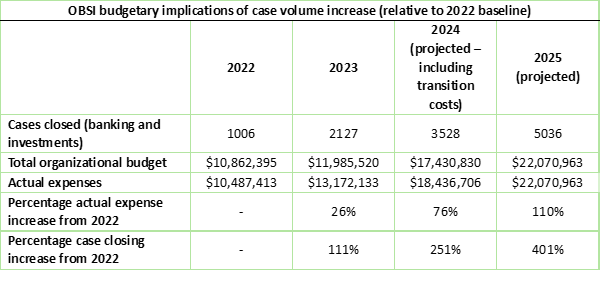

Throughout this recent period of growth, OBSI has realized significant economies of scale and scope in its operations. Following the transition to the single-ECB system, investigation volumes are expected to rise to over 5,000 cases. As illustrated in the chart below, relative to baseline 2022 levels, this represents an increase in case closing productivity of approximately 400% on budgetary increases of approximately 110% - or five times the case closing capacity with approximately a doubling of the budget.

2025 sector fee allocation

When allocating our budget among the sectors that use our service, our board considers the number and complexity of cases opened for each firm in the previously completed year. For 2025, we have also considered the cases opened by transitioning banks at the ECB they used in prior years.

In addition to OBSI’s 2025 budgeted operational expenses, the fee allocation includes $2 million as part of a three-year plan to replenish and build our reserve fund, which is currently $6.4 million below its target level (which is 50% of the annual budget).

Although complexity weighted case volumes increased for all sectors, the most significant share of the 2025 fees are allocated to the banking sector. The significant proportion of fees paid by the banking sector is due to the extraordinary increase in banking case volumes and the inclusion of the returning banks’ case volumes. Most investment firms will see fee decreases as a result of economies of scale and scope in our operations.

Banks: Total fees for the banking sector will increase by 235% in 2025, which reflects the significant increase in case volumes for the sector and the return of the transitioning banks. Please note this does not mean the fees for all banks are increasing by this amount. These fees will be allocated among all banks, including the transitioning banks.

In 2024, in anticipation of the single ECB transition, OBSI engaged in a fee allocation methodology consultation with all banks. As a result, the bank fee allocation model has changed as reflected here, which will impact individual bank fees.

Banks and federally regulated financial institutions with three-year average case volumes of less than one complaint per year will be charged a flat annual fee of $2,500.

Credit Unions: Fees for this sector will remain unchanged for 2025, as case volumes for the sector remained flat.

Investment Dealers and Mutual Fund Dealer firms: The fees for CIRO firms will decrease by 23%, due to economies of scale in OBSI’s operations. Case volumes for this sector increased 35% last year from the prior year.

Non-CIRO firms: This sector includes EMDs, PMs, IFMs, Restricted Dealers and firms with multiple registrations. The fees for this sector overall will increase by 16% from 2024 levels and per representative fees will increase to $190 from $165 in 2024. Case volumes for these sectors increased 77% last year from the prior year.

Scholarship Plan Dealers: The fees for this sector overall will decrease by 9% from 2024 levels. Case volumes increased 60% year over year for the sector.

Expect to hear from us in November

OBSI’s fiscal year begins on November 1. Your firm can expect to receive instructions in November on how to complete your membership renewal.

Firms who are invoiced annually or quarterly will be contacted with their invoices and provided with options for completing their payments.

Firms who use the OBSI Firm Portal to calculate and process their membership renewals will receive detailed information and instructions for logging into the Portal and paying via the Portal once the form is available on November 1, 2024.

If you have any questions or concerns, please email membership@obsi.ca or call 1 888 451-4519 x 2454.