Firm Bulletin: 2024 Fees for Participating Firms

As a not-for-profit organization, OBSI recovers all of its budgeted operating expenses from its participating firms each year. OBSI's budget and the allocation of this budget between the different industry sectors that use OBSI's services is approved by OBSI's Board of Directors each September. Our board also considers fairness and the impact of fee changes on member firms when setting fees. A guiding principle is that no sector or registrant category should subsidize another.

The allocation of the budget among the five industry sectors is based on each sector’s proportionate use of our service. This is determined by the total number and complexity of the cases opened for each sector in the previously completed year. Once the budget has been allocated to each sector, fees for each firm in the sector are determined. This determination is made on the basis of firm size as described here.

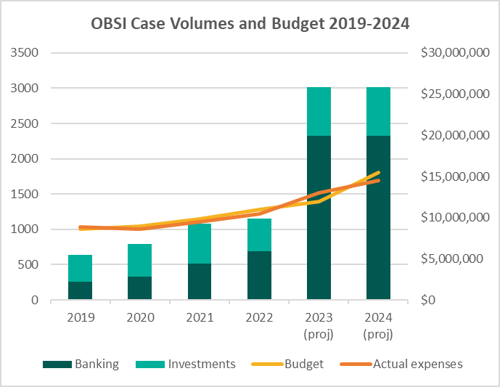

Overall budget is increasing as efficiencies of scale and scope offset record consumer demand

OBSI’s budget is set at a level required to recover the estimated cost of providing services in the coming year. A key factor that determines our needs is expected consumer demand (essentially the volume of case inquiries and case investigations), and the estimated resources required to meet that demand in the coming year.

Year to date in 2023, consumer demand has driven overall case volumes up 261% (i.e., more than triple) led by banking consumer case volumes which have increased over 300% (i.e., more than quadrupled) and investment complaints that are up more than 60% from last year’s record high levels.

To meet this extraordinary surge in demand in 2023, we increased hiring significantly during the year adding multiple new investigative and case assessment teams. As this required hiring was unbudgeted for 2023, it has required OBSI to draw from our reserve fund to ensure continuity of service. Our board has determined that it is appropriate for us to recover the full amount of this deficit from participating firms in 2024. This adds approximately $1 million to our fee target for 2024. Notably, this is a one-time cost recovery, and is not expected to recur in future years.

For 2024, we expect to continue to respond to increased case volumes due to regulatory changes in the banking sector, and continued market volatility and financial uncertainty related to inflation and interest rate changes. To deal effectively with this ongoing consumer demand and growth in case volume, we will need to ensure that we have adequate staff resources to maintain our service levels.

OBSI’s budget in 2023 was approximately $12 million and our actual expenses were approximately $13 million. Our preliminary projection for our 2024 budget is approximately $15.5 million – a 30% increase from the 2023 budget – to address an estimated 261% increase in case volume. However, the most significant share of this increase will be allocated to the banking sector as banking complaints have been the core driver of complaint volumes following the Bank Act changes in 2022.

2024 participating firm fees

Outlined below are the 2024 fees by sector, which are determined based on each sector’s relative case volume and complexity.

Banks: The fees for the banking sector will increase by about 160% relative to 2023. Banking case volumes in 2023 increased 300% from the prior year. The flat annual fee for banks and deposit taking institutions with assets under $3 billion and foreign bank branches with no recent complaints remains at $2,400.

Credit Unions: Fees for this sector will remain unchanged for 2024, as case volume remained flat.

Investment Dealers and Mutual Fund Dealer firms: The fees for CIRO firms will increase by 9%. Case volumes for these sectors increased 40% last year from the prior year.

Exempt Market Dealers & Portfolio Managers: The fees for this sector overall will increase by 4% from 2023 levels and per representative fees will increase to $165 from $153 in 2023. Case volumes for these sectors increased 23% last year from the prior year.

Scholarship Plan Dealers: The fees for this sector overall will increase by 6% from 2023 levels. This sector fee model is under review due to structural changes in the industry. Discussion with impacted SPDs are currently ongoing with respect to the calculation of individual firm fees.

Fees for each firm within each sector are set proportionately on the basis of firm size. In some sectors, size is determined by each firm’s assets and in other sectors by number of registered representatives.

Expect to hear from us in November

OBSI’s fiscal year begins on November 1. Your firm can expect to receive instructions in November on how to complete your membership renewal.

Firms who are invoiced annually or quarterly will be contacted with their invoices and provided with options for completing their payments.

Firms who use the OBSI Firm Portal to calculate and process their membership renewals will receive detailed information and instructions for logging into the Portal and paying via the Portal once the form is available on November 1, 2023.

If you have any questions or concerns, please email membership@obsi.ca or call 1 888 451-4519 x 2418.