Limitation Period

OBSI's approach to the six-year limitation period

What is a limitation period?

As a general legal principle, anyone who knows they have a claim against another person is required to make their claim within a reasonable amount of time, or they lose the right to do so. This is because allowing people to hold their claims forever and only bring them forward when they feel like doing so is harmful to the person they are claiming against. Also, it is more difficult to find reliable evidence about things that happened in the distant past. The period of time in which a claim must be brought forward in the courts is known and the "limitation period."

Limitation periods are provincial laws and are a bit different in each province. The limitation period is two years for most court actions in most provinces and three years in Quebec. There are exceptions and it is very important for people with possible claims to get legal advice about the limitation period that applies to them.

OBSI's limitation period

Legal limitation periods don't apply to OBSI. But for fairness reasons, we impose a limitation period on claims that consumers bring to us. Our rule is found in section 5.1(e) of our Terms of Reference (TORs). This limitation period was recommended by an external review in 2012. It was added to our TORs in December 2013 after a public stakeholder consultation process. OBSI's limitation period is six years.

This means that we will only consider a complaint if the consumer raised their complaint with their firm within six years after the consumer knew or ought to have known about the problem. Once the consumer receives the firm's response, he or she must complain to our office within 180 days.

We cannot investigate a complaint, or will stop investigating, if we determine that it is outside this six-year limitation period. If we can determine this before we open the case, we will let the consumer know right away. However, we often need to begin an investigation to be able to determine if a consumer took too long to complain.

When does the six-year limitation period start?

OBSI's limitation period starts on the earlier of:

- the day on which the consumer first knew about the issue or problem.

- the day on which the consumer reasonably ought to have known about the issue or problem.

The day on which the consumer first knew about the problem can be determined by considering:

- when they were first told about the problem;

- when they first complained about it; or

- when they took action to address the problem (such as selling investments or changing banks).

We determine the day when a consumer ought reasonably to have known about an issue or problem by considering what a reasonable person in the complainant's circumstances, with the complainant's abilities and limitations, ought to have known. This includes a consideration of:

- the nature of the relationship between the consumer, the advisor, and the firm.

- the consumer's level of investment or banking experience, knowledge and sophistication.

- the timing, form and nature of the information provided to the consumer and their ability to understand it.

- whether and when the consumer raised any concerns with the advisor or firm about the circumstances leading to the complaint, what advice they received, and what action, if any, was taken.

Other time limits may also affect a case

There are a number of other time-based mandate and investigation issues that also need to be considered. Some of these are:

- The bank or federal credit union has had 56 days, or the investment firm or provincial credit union has had 90 days unless the complaint is from a Quebec resident, then the firm has 60 days (with exceptional circumstances allowing it to extend to 90 days) to consider and resolve the complaint from the time the complainant complained to them. This period ends when the firm sends the consumer their final response letter, even if the 56, 60 or 90 days has not passed.

- The consumer has to bring their complaint to OBSI within 180-days after receiving the firm's letter.

- Losses associated with the complaint may be calculated on a different timeframe, for example:

- We may open a case that came to us within six years of when the consumer knew or ought to have known of the problem, but their losses may have started many years before that. In that case, we will consider the losses from before the six-year period.

- We may also end our loss assessment at a time when we believe the consumer should have mitigated their losses.

How the six-year limitation period works

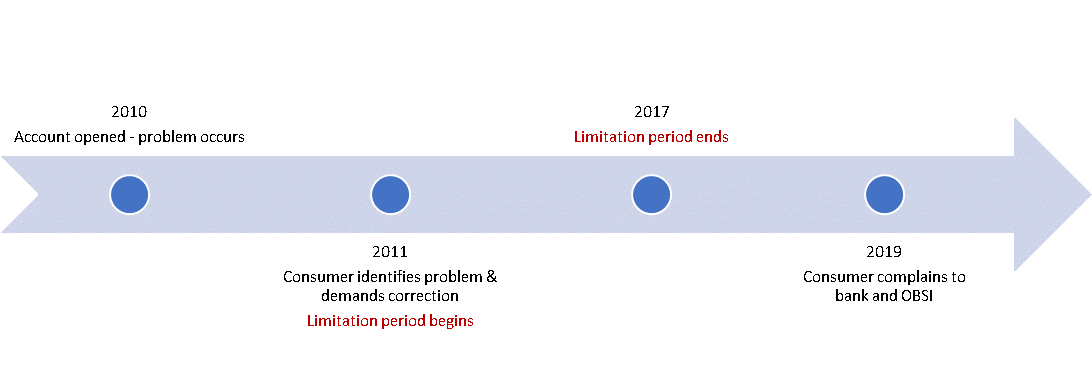

Example 1 – OBSI case not opened

A consumer opened a new bank account in 2010. She was charged account fees of $29.95 per month.

In 2011, the consumer realized that her account fees should have been $14.95 per month. She transferred her money to another bank and closed her account.

In 2019, the consumer contacted her previous bank to complain about the excess fees she was charged. Unsatisfied with the bank's response, she contacted OBSI.

When we first received the complaint, we determined that the consumer had discovered the error and transferred her account away from the firm eight years before complaining to the firm.

Therefore, the case was clearly out of mandate on the basis of our six-year limitation period. We informed the consumer that we would not be investigating their complaint. The consumer was sent a closing letter explaining the reason for our finding.

Figure 1: OBSI six-year limitation period elapsed

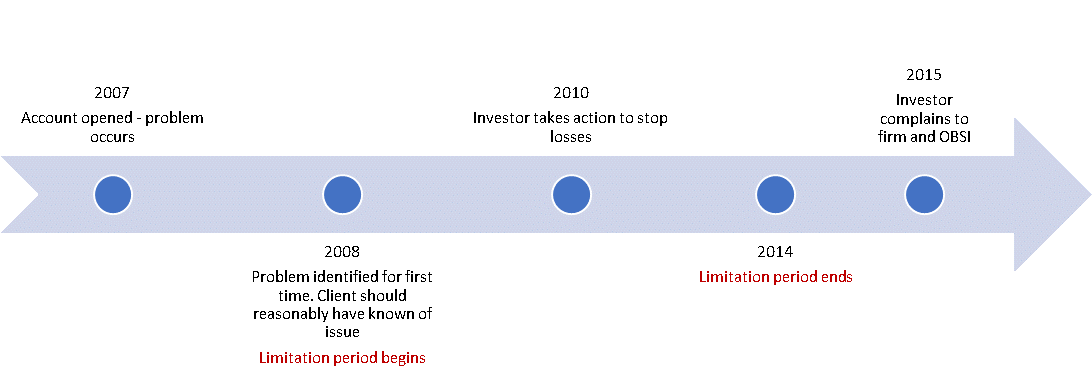

Example 2 – OBSI case opened, then closed during investigation

An investor with moderate investing knowledge opened a new account in 2007 and requested guaranteed, low-risk investments. Her advisor instead invested the account in medium-risk mutual funds.

In 2008, the market experienced a large downturn which significantly decreased the value of her investments. She had believed her investments were guaranteed and knew they should not decline in value. However, all her friends experienced similar losses and her advisor had told her that her investments would come back in value.

In 2010, the consumer's investments continued to fluctuate in value, but never fully recovered from the losses she incurred. She demanded that her advisor switch her investments into safe investments, which he did.

In 2015, the consumer complained to the firm about losses she incurred due to unsuitable investments. Unsatisfied with the firm's response, she contacted OBSI.

The limitations issue was identified when the case was opened and the Investigator examined that issue first. They focused on what occurred in 2008 when the consumer noticed a large downturn, even though she said she believed her investments were guaranteed and low-risk.

The investigator concluded that in 2008 the investor ought reasonably to have known that her account was not invested in guaranteed and low risk investments. Therefore, the six-year period for the investor to complain to the firm began in 2008, when the consumer reasonably should have known of the problem and ended six years later, in 2014.

Because the case was out of mandate the Investigator did not investigate the issues of her instructions not being followed or the suitability of her investments and did not calculate her losses. They discussed our findings with the investor over the phone and through the investigation closing letter and closed the file.

Figure 2: OBSI six-year limitation period elapsed

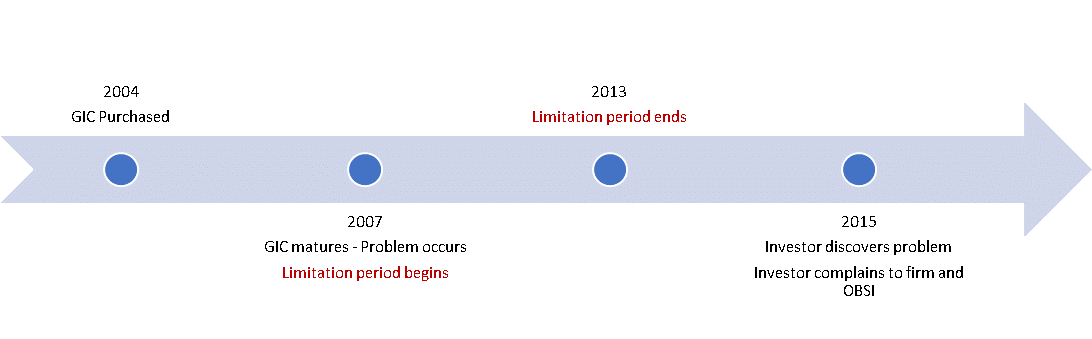

Example 3 – OBSI case opened, then closed during investigation

In 2004, a consumer purchased a three-year GIC with quarterly interest payments.

The consumer received all interest payments until the GIC matured at the end of year 2007. However, since the bank did not receive payout instructions for the principal, when the GIC matured it was invested in three-month T-Bills. The T-bills continuously rolled over, and the interest was reinvested, in accordance with the bank's policies.

In 2015, upon reviewing old files, the consumer discovered that he still had what he believed was a GIC with the bank and requested a redemption. The bank redeemed the T-Bill and sent the consumer his original principal plus interest he had earned at the T-Bill rate.

He complained to the bank asking for interest he would have earned on GICs, which was higher than the T-Bill rate. Unsatisfied with the bank's response, he contacted OBSI.

When the case was opened, we noted that the issue giving rise to the complaint had occurred 11 years before the complaint to the bank. When the investigator began work on the case, the limitations issue was the issue considered.

The investigator examined the evidence available and determined that the consumer should reasonably have known of the problem at the end of 2007, when he did not receive his principal back and stopped receiving quarterly GIC interest payments. Therefore, the limitation period began in 2007 and ended six years later in 2013.

Since the consumer did not actually complain to the bank until 2015, the investigator found the case out of mandate and closed the case. They discussed our findings with the consumer, included our reasons in the investigation closing letter and closed the file. An investigation of the consumer's losses was not necessary.

Figure 3: OBSI six-year limitation period elapsed

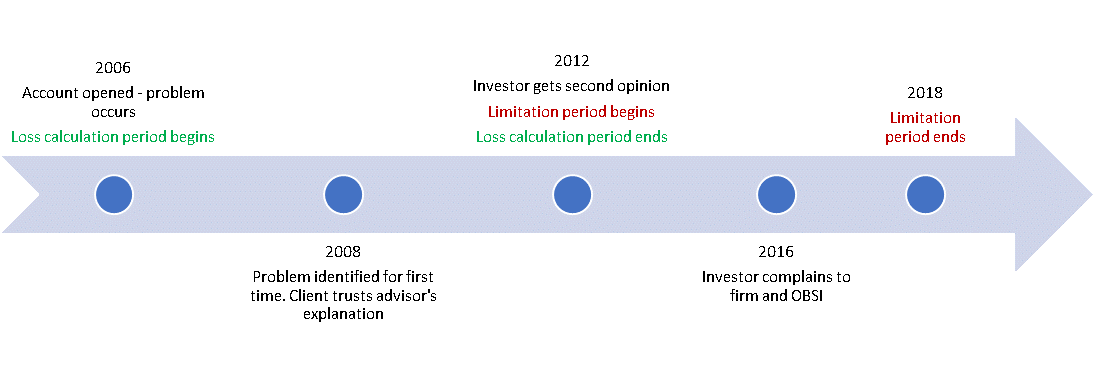

Example 4 – OBSI case opened and investigation completed

An unsophisticated investor opened a new account and received an unsuitable recommendation in 2004.

In 2008, the investor thought there was a problem with the advice he received in 2004, even though he couldn't specifically or accurately describe it. He raised his concerns with his advisor and was told his investments were appropriate and he should remain invested. He trusted his advisor's advice.

In 2012, the investor sought an opinion from a different advisor and was told his investments were unsuitable.

The investor complained to the firm in 2016, and to OBSI later that year.

When we opened the case, we noted that the issue giving rise to the complaint occurred 12 years before the complaint to the firm. We also noted that the consumer indicated that they may have known of the problem eight years before complaining to the firm, but it was not clear that this was the case.

Once the investigator began work on the case, they examined the issue of what happened in 2008. The investigator determined that the consumer was unsophisticated and reasonably relied on their advisor's advice at that time.

The investigator then considered what happened in 2012. They determined that the consumer then knew or reasonably ought to have known about the problem at that time after they had consulted with an independent professional. Therefore, that was when the limitation period began. The investigator also determined that this was when the loss calculation period ended because, at that time, the consumer should have been able to mitigate their losses.

Therefore, the investigator determined that there was no limitation period problem in this case. The loss calculation period would run from 2006 to 2012. The investigator completed the investigation.

Figure 4: OBSI six-year limitation period & loss calculation period